Preparing good meals and serving customers is always an exciting part of running a restaurant. When it comes to numbers, however, most restaurant owners do not know what is expected of them. Opening a restaurant may have been your dream, but keeping everything intact is crucial to running a successful business. You need to ensure that the numbers add up, and your revenues cover all the costs incurred. So, where does accounting come in?

Restaurant accounting ensures you have proper financial records and determines the restaurant’s financial health. One of the most important aspects of running a restaurant business, accounting keeps check of your costs, build strategies for more profits, and maintains tax obligations. However, most restaurateurs lack the essential accounting knowledge needed to run a successful business. In this article, we are going to look at some of the most effective restaurant accounting tips:

- Understand Restaurant Accounting Terminology

Understanding accounting terminology and language is key to running an effective restaurant accounting system. The accounting language may seem difficult for people who are not trained in accounting or those who have no interest in matters accounting. However, this does not mean that accounting is too difficult to understand. If you are curious enough and know the worth of accounting for your business, you will dedicate yourself to learning the basic concepts.

Take time to understand terms like labor costs, costs of goods sold (COGS), prime costs, revenue, balance sheet, income statement, and more. The more you learn about these terms, the more you understand your finances. It also means that you will be able to get the meaning behind accounting numbers or financial reports of your business.

- Hire a Professional Specializing in Restaurant Accounting

The role of the accountant in a restaurant cannot be over-emphasized. This is the person who prepares the financial statement, interprets accounting records, and ensures the business is tax compliant. For an effective accounting process, you need to hire the right accountant for your restaurant business. A good accountant will help you in managing finances and producing key financial statements.

Since accounting in the restaurant industry is quite different from other industries, look for someone who has experience or specialization in restaurant accounting. Someone who understands specific restaurant accounting features like a chart of accounts, COGS, prime costs, daily sales, and more.

- Find the Right Restaurant Accounting System/Software

In this modern era, a good restaurant accounting system is a necessity for any business. Even if you have a good accountant for the day to day bookkeeping duties, an accounting system is needed to automate some of the processes and ensure accuracy. Gone are the days when tracking financials used to be a time-consuming and an uphill task. With the emergence of this new technology, you no longer have to worry about creating ledgers or columnar pads for your restaurant.

Some of the reputable accounting systems include Sage, Xero, NetSuite, Dynamics GP, and QuickBooks. Of course, you will need to consider factors like your business needs, your budget, and data security when choosing the right system. Make sure that the accounting system you choose is cloud-based or web-based, which is more relevant to today’s world.

With an automation tool like Sourcery, you can integrate the system into your restaurant management applications. This allows you to process, extract, and transfer data between the accounting system and your restaurant POS system.

- Install a Good Restaurant POS System

A good point of sale (POS) system is critical to restaurant accounting. Your restaurant POS system should seamlessly integrate both the back-of-the-house (BOH) and front-of-the-house (FOH) operations. This ensures a greater level of accuracy in the restaurant accounting processes. The system will help you track your labor and inventory costs, methods of payment, and other important information.

When looking for a restaurant POS system, go for the one that helps you maintain your accounts. Regular accounting does not only involve knowing the number of expenses or revenue generated over a given period of time. It also involves reviewing the financial health of your restaurant and using this information to make better decisions for your business. A good POS system should give you a detailed break-down of your numbers in easy-to-comprehend charts. It should also allow you to conduct a detailed analysis of your accounts, where you can compare business financial performance across different periods.

- Keep Track of Your Expenses

Expenses are a normal part of running any restaurant. The trick is keeping these expenses under control and reducing their overall impact on the business bottom line. One of the factors that determine the amount of expenses incurred is the payment arrangements you have with your vendors. Your bills could be coming on a weekly basis, once every two weeks, or monthly. To keep better control of your expenses, start by paying your bills weekly. Make sure you note the amount of money going out every week. This will help you notice any changes in the bills, and take the necessary measures before the expenses start eating your profits. Avoid piling up your bills, but try to pay them as soon as they are due.

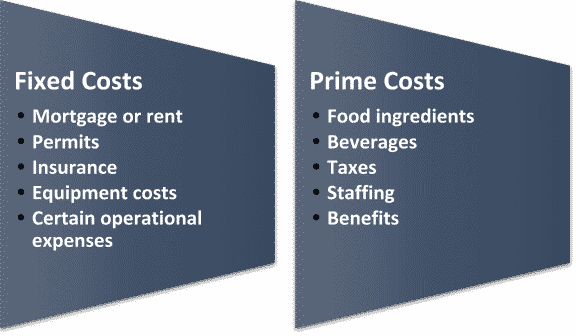

Restaurant expenses fall under two categories: fixed costs and prime costs. Fixed costs comprise of the expenses that do not change with the level of sales. They include the cost of paying a mortgage or rent, permits, insurances, equipment costs, and certain operational expenses. They form the minority expenses of running a restaurant. On the other hand, prime costs are the majority and include all the expenses that change with the sales volume. This could be the cost of buying food ingredients, beverages, taxes, staffing, and benefits. You need to keep a close eye on the prime and keep them at the minimum because they have a direct impact on the restaurant’s profit.

- Track Restaurant Inventory

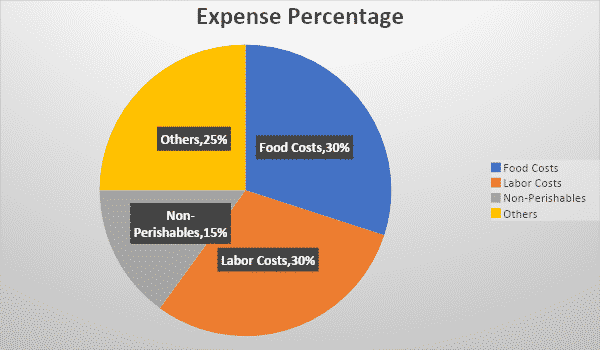

Tracking inventory can mean the difference between making or breaking your business. Restaurant labor costs, alongside food and beverage, comprise the largest expenses. Food costs on their own already comprise 30% of total expenses. When combined with labor costs, the figure jumps to 60%. When you factor in non-perishable items like tableware, cleaning supplies, paper towels, and kitchen equipment, the total cost is about 75% of your expenses.

The importance of tracking your inventory expenses can never be overlooked. If you spend too much on your inventory, it could mean your profit margin is suffering. You need to ensure that your inventory expenses are below the ideal percentage:

Food Cost Percentage = (Beginning inventory + Purchases – Ending Inventory)/ Food Sales

- Check Sales Regularly

For you to determine the profitability of your business, you need to have a close eye on your sales. Most of the restaurant sales are completed via credit cards when the customer pays for the service. However, most credit card terminals require restaurant owners to close out sales batch on a daily basis. This step is necessary because it allows the credit card company to process your money and transfer it to your bank account. To keep accurate records of your sales, you should reconcile this report with the restaurant activities. Instead of waiting until the end of the week to do the reconciliation, focus more on preparing daily sales reports. This will give you a more accurate picture of the day to day sales and allow you to make better decisions in relation to inventory and staff shifts.

- Outsource Your Payroll if Necessary

Outsourcing payroll can be an effective way of streamlining restaurant accounting. While you could still do payroll yourself, outsourcing saves you the cost and liability involved. One of the major benefits is that your business will be compliant with the ever-changing payroll laws and taxes. You will have a trained professional working on your restaurant payroll to ensure compliance with all the state, local, federal, and workforce requirements for the employees.

The other benefit is that outsourcing payroll saves the cost of having to go through your employee’s payroll on a weekly basis. The professional will take care of everything, and all you will be interested in is the labor cost involved for accounting purposes. You will also get timely reports of your payroll to ensure you are not incurring too much in paying your staff.

- Pay Taxes on Time

Restaurant sales are subject to both state and local sales tax. You are also required to adhere to payroll taxes, state unemployment, Medicare taxes, and Social Security for your employees. While an accountant will help in ensuring you comply with the necessary tax requirements, you need to have a look at your local and state laws to know what is expected of your business.

As a restaurant owner, you have a duty of ensuring your business is not missing any regulatory requirements. Usually, sales taxes are required to be applied when a customer purchases and pays for a service or product. Understanding how the tax process works will save you from any unnecessary fines that may emerge for lack of compliance.

- Produce Regular Financial Reports

The role of financial reports is to show how the restaurant is doing financially. You can tell apart areas of the business that are performing well and those that need improvements. You also get insights into the financial performance of the restaurant against the competition. The more regular you produce such reports, the more accurate the picture you get on the performance of the business.

Your main focus should be on numbers like sales vs. expenses, COGS, prime costs, labor costs, and other expenses that affect your restaurant operations directly.

Try to generate the profit and loss statement on different timelines like weekly, monthly, and yearly to see where your business is going financially. The P$L is effective for keeping track of the restaurant revenue, labor costs, food costs, and operating expenses as it keeps all accounting information in a concise manner. Also, learn to make sense of the numbers and to analyze them to better financial decisions.

Other financial reports that you need to produce and analyze on a regular basis include the cash flow statement and the balance sheet.

Concluding Remarks

A lot goes into restaurant accounting, and you are likely to miss some things if you are not keen enough. Utilizing the above restaurant accounting tips will make the work easier for you. You do not have to be a trained accountant to keep your numbers in check. All you need to do is gain interest in restaurant accounting and seek out the right information.