Running a restaurant comes with its own fair share of challenges. While there are several things to consider in keeping the business in operation, managing costs is among the most important. A good starting place is understanding what your prime costs are and how to minimize them. In this article, you will get answers to:

- What are a restaurant’s prime costs?

- How do you calculate a restaurant’s prime costs?

- What is the ideal prime cost ratio?

- Why should I care about my restaurant’s prime costs?

What are a restaurant’s prime costs?

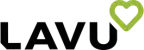

Prime cost number in a restaurant represents what is known as the direct costs. It includes COGS and labor costs. This figure includes food cost and liquor, and any other direct costs incurred in producing the products and services of your restaurant. A simple way to look at it is thinking of the costs needed to manage the day to day revenue of the business.

How do you calculate a restaurant’s prime costs?

The restaurant prime costs are a combined cost of COGS and labor. In restaurant accounting, the following formula is used:

Prime cost = Cost of Goods Sold (COGS) + Total Labor Cost

If your COGS is $4,500 and your total labor cost is $6,000, then your prime cost is $10,500 (4,500+6,000)

To get a clear understanding of this formula, let’s have a look at what each component means.

Cost of Goods Sold (COGS)

The COGS is the total cost of the products that the restaurant sold over a specific period of time. To determine the COGS for your restaurant, you need to take an accurate inventory of the storeroom, bar, and walk-in. At the start of the period, your inventory could be $5,000. After running the restaurant for a specific period, like a week, an inventory count may be different. During the period, you could have received $1,500 worth of delivery while the end of the period inventory count is $3,000. To calculate your cost of goods sold, you need to work with these numbers.

COGS = Starting inventory + purchases – ending inventory

In this case, COGS = 5,000-3,000+1,500 = $3,500

Total Labor Cost

Although labor costs vary depending on the type of restaurant, this cost is usually between 30 and 35% of the total sales. For more accurate estimates of the labor cost including salaries and wages, you need to divide the front of the house labor costs with the back of the house. While the front of the house labor includes payment to floor managers, wait staff, bussers, bartenders, and hosts; back of the house includes kitchen staff, chefs, and dishwashers.

A good place for restaurant owners to start when calculating total labor costs in a restaurant starts with adding up all the salaries and wages that employees earn in a period (say a week). You then other labor-related costs like payroll taxes, employee health insurance, workers’ compensation insurance, taxes, benefits, and insurance. This information is easily retrievable if you have a good POS system or your restaurant uses technology to schedule employee shifts. Your restaurant operator or account also keeps this information for easy access.

Prime Cost as a Percentage of Sales

In order to determine whether your restaurant prime costs are ideal, you need to calculate as a percentage of sales. The formula is as follows:

Prime cost ratio = Prime Cost/Total Sales

In our scenario, if the sales for the restaurant are 7,500, then the prime cost percentage = 46.67% (3,500/7.500).

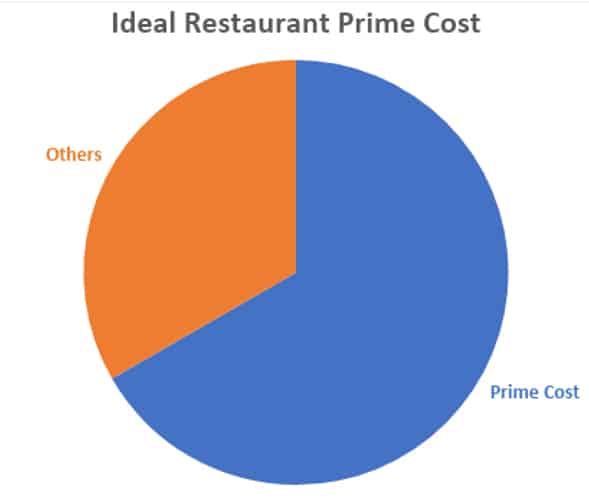

What is the ideal prime cost ratio?

The ideal prime cost ratio for a restaurant is approximately 60% of the total revenue generated from food and beverage sales. Full-service restaurants that operate below 60% are considered to have a healthy prime cost. If your prime cost is above this percentage, then you need to take action to mitigate.

Why should I care about my restaurant’s prime costs?

Restaurant prime costs are crucial to the bottom line of your business. Several factors make prime costs important to your business.

First, they make up the largest expenses of running a restaurant. Without prime costs, it would be impossible to run a restaurant. Second, they are dynamic as they tend to change with several factors. Therefore, you need to keep track of them to ensure you are running a profitable business. Third, prime costs affect all the operations of the restaurant but they can be controlled. You set your prices, hiring employees, and set sales goals based on your prime costs. Fourth, you can understand your restaurant’s true profitability by looking at your prime costs.

By accurately calculating your restaurant direct expenses, you can determine your total profit margin.

Given the importance of prime costs in running a restaurant, it is important to have accurate calculations. If you are still having difficulties understanding this concept, a prime cost calculator can help. You also need to set prime cost targets to ensure you are operating within the friendly zone.