Owning a restaurant is both an exciting and challenging experience. Before the challenge of making a profit, you also have to identify sources of financing. Restaurant financing and restaurant loans are crucial to successful running of a restaurant. You need funds to restock your inventory, pay your staff, obtain or renew permits, buy business assets, and replace your restaurant equipment. This article will delve into this in more details by focusing on:

- Definition of restaurant financing

- Types of restaurant financing

- Evaluating and choosing the best restaurant financing option

- Uses of restaurant financing and loans

Definition of restaurant financing

Simply put, restaurant financing is the money loaned, borrowed, or sourced from an external party. The purpose of sourcing the money could be to start a restaurant, expand to a second location, or refurbish the premises. Regardless of the purpose, restaurant financing is vital to running a successful business and ensuring smooth cash flow.

Types of restaurant financing

The restaurant industry has a high start-up failure rate. About 20% of restaurants fail within their first year of operations, which makes banks more stringent in offering restaurant loans. Normally, a bank will require a lot of information and reassurance before approving a loan for a restaurant business. Nonetheless, there are several financing options at the disposal of restaurant owners and management. Explore the options from cash advances for emergency funding to capital loans for major purchases.

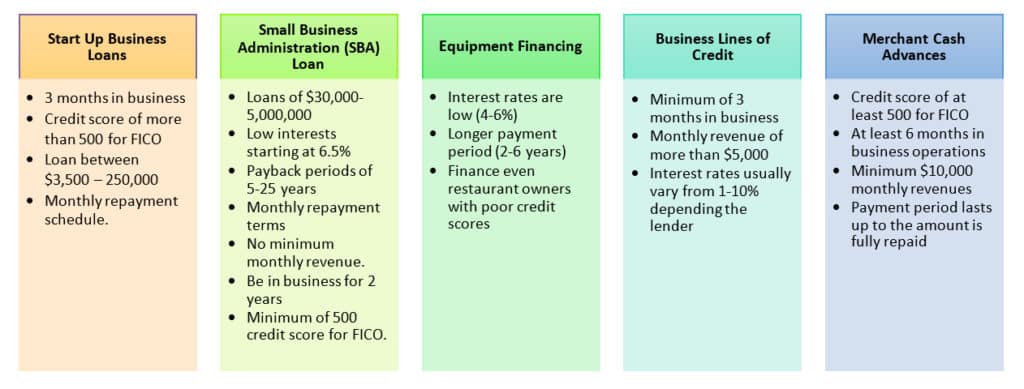

- Start-Up Business Loans

A start-up business loan is ideal for those who want to establish a restaurant from the ground up. This type of financing is helpful to those who have an idea of the restaurant they want but lack the finance for their restaurant startup costs. What makes this type of loan attractive is that it can finance even young restaurants and attracts minimal qualifications. For instance, you will be required to have been in business for 3 months and have a credit score of more than 500 for FICO. The loan will range anyway from $3,500 – 250,000, with a monthly repayment schedule.

- Small Business Administration (SBA) Loan

An alternative financing option is financial assistance from the U.S. Small Business Administration (SBA). The administration provides financing assistance to small business owners, with an up to 85% guarantee of a business loan. For restaurant owners, this means that SBA loans can finance your restaurant even when you are not sure of your ability to repay the loan in full. Although SBA does not provide the funds itself, it provides a safety-net for lenders that allows them to approve restaurant business leans applications. Some of the attractive features of SBA loans include loans of $30,000-5,000,000 with low interests starting at 6.5%, payback periods of 5-25 years, monthly repayment terms, and no requirement for minimum monthly revenue. You are required to be in business for about 2 years and have a minimum of 500 credit score for FICO.

- Equipment Financing

The productivity and quality of a restaurant’s service has to do with the kitchen equipment. The better the equipment, the more quality is the food and the more satisfied are the customers. This makes it important to have the latest cooking apparatus in your restaurant. Equipment financing allows you to purchase the right equipment for your business without being left in a hole of debt. A major consideration is the available equipment loans and terms of equipment leasing/purchasing. The good thing with these types of loans is that interest rates are low (4-6%), have a longer payment period (2-6 years), and finance even restaurant owners with poor credit scores.

- Business Lines of Credit

On a continuous basis, restaurants need to restock their shelves to remain in business. However, the rate of stock replacement for any given ingredient keeps on shifting with the demand. Due to this unpredictable nature of the monthly expenses, business lines of credit offer a safety net for restaurant owners. They allow a restaurant to borrow any amount of money, providing a place to run to when the business needs money the most. This type of financing requires you to be in business for a minimum of 3 months, with a monthly revenue of more than $5,000. The interest rates usually vary from 1-10% depending on the lender.

- Merchant Cash Advances

Merchant cash advances are useful to restaurant owners in need of a quick short-term loan, even within 24 hours. The option is usually used as a last case scenario when a restaurant business is in need of a quick financial boost to overcome a demanding billing cycle. This could be an unplanned restaurant renovation or replacement of equipment after a sudden breakdown. The requirements for this type of financing include a credit score of at least 500 for FICO, at least 6 months in business operations with a minimum of at least $10,000 monthly revenues.

- Unsecured Business Loans

Small business owners can utilize unsecured business loans when in need of financing. They offer the best loan terms for business owners with a relatively high credit score. Since they require no collateral, the lender requires a higher credit score since they are taking a bigger risk on the borrower. This means that the qualifications for these loans are more strict, come with higher interest rates, and take a longer period of time to repay.

- Online Lenders or Crowdfunding

Crowdfunding from online lenders is also a good source of financing a restaurant. Restaurant owners or managers pitch their product or business ideas to online leaders in exchange for a benefit. Some of the popular crowdfunding sites include GoFundMe, IndieGoGo, KickStarter, and Patreon. Since the process of crowdfunding is easy and straightforward, you can access a broader investor base. However, it is important to consider the amount of information disclosure needed and the loan amount you can raise from a lender.

Choosing the Best Financing Option for Your Restaurant

Before making a loan application, you need to ensure that you are applying to the right financing option. Several factors should guide your loan application process to ensure the source you choose is appropriate. You may need to look at your restaurant business plan to determine your goals, and establish the amount of money you need. The following considerations are necessary for evaluating and choosing a financing option:

- Time it takes to get the capital: Before choosing a financing option over another, you need to consider how long it will take for you to get the capital. If you need quick cash, then a lender with a lengthy processing period and eligibility criteria may not be ideal for you.

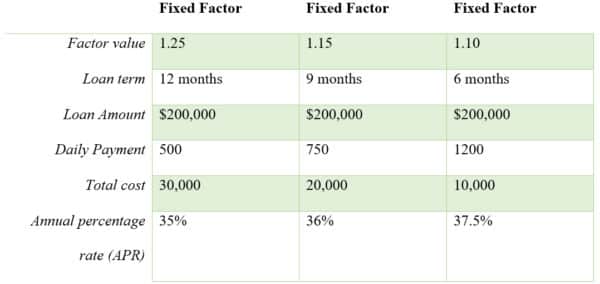

- The total payback: You need to look at the cost structure that potential lenders use and the factors they consider in calculating the total payable cost. Consider the total payback amount, compounding interest, upfront fees, annual percentage rate (APR), and other possible penalties that may add up to the amount you will pay back.

- Compare Loan Terms: Make sure you also compare the repayment terms of the financing options you are considering. This is the amount of time you will be required to repay the loan and the amount you will be repaying at each installment. The following example demonstrates how the loan term can result in different repayment amount.

- Collateral Requirement: If you do not have an asset to provide as the security for the loan, you may need to consider the unsecured loans option.

- Fixed Rates vs. Variable Rates: When making the financing option decision, consider whether interest rates with fixed rates or variable rates are more affordable. Depending on the loan amount you are seeking, one may be more affordable compared to the other.

- Lender’s Reputation: Always find out the reputation that the financial provider holds. You need to consider how they deal with repayments, what they do in case of a missed payment, and how well they deal with restaurant businesses.

Uses of restaurant financing and loans

Restaurant owners apply for loans and source money for various reasons. The motivation is usually to make the business competitive and attract more customers. Financing provides them with outside capital that can be used to:

- Start a new business

- Make payments to employees, from managers to dishwashers

- Buy or replace back of house (BOH) and front of house (FOH) equipment

- Install and maintain a restaurant POS system

- Restock food, drinks, ingredients, cleaning supplies, alcohol, and more

- Market and advertise the restaurant to attract more customers

- Recover after a major disaster or event hit the business

- Make ongoing repairs, including plumbing, building, and electricity

- Finance additional operational expenses

- Renovating the restaurant to accommodate more customers

While there are many options for restaurant financing, it would save you a great deal to plan early. Planning early allows you to choose the most appropriate restaurant loans for your business. You will have enough time to evaluate the various financing options and match what meets your financing needs the best.